Welcome.

-

Alpha and Beta with Modern C++ Ranges

This article demonstrates the power of modern C++ in financial analysis context. It is aimed at those already familiar with C++ as it does not define basic programming concepts, however it will demonstrate the use of some new C++20/23 features. If you are a intermediate C++ programmer looking how to apply skills to a real…

-

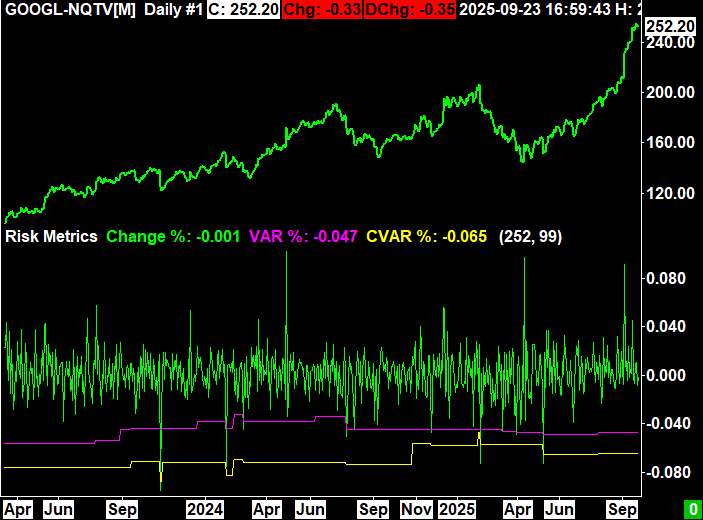

Risk Measures: Value At Risk

This blog post introduces a new custom study to Sierra Chart which adds two popular risk metrics: value at risk (VAR) and conditional value at risk (CVAR). The study does a historical VAR and CVAR calculation given the length of the look back period and the confidence interval.

-

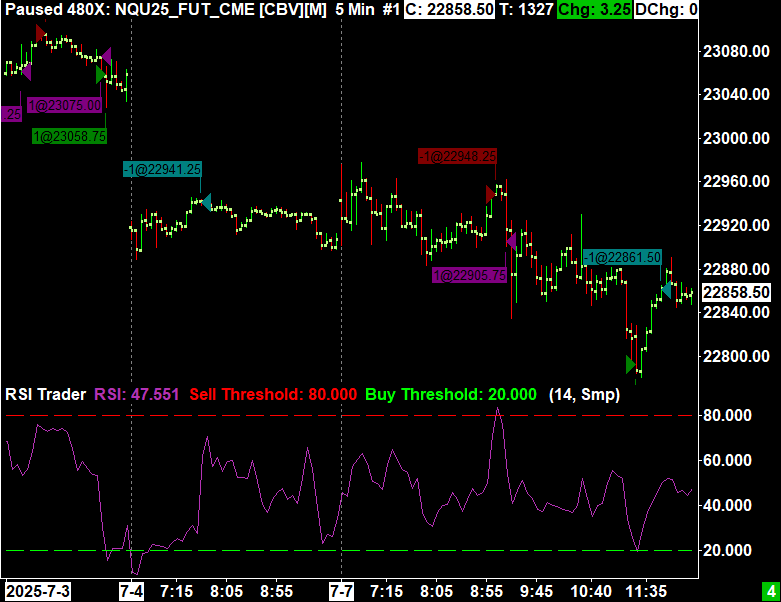

Algorithmic Trading Basics: Sierra Chart

This blog post will cover how to submit orders and get position data using Sierra Chart’s ACSIL. It also includes back testing results from a RSI strategy.